|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

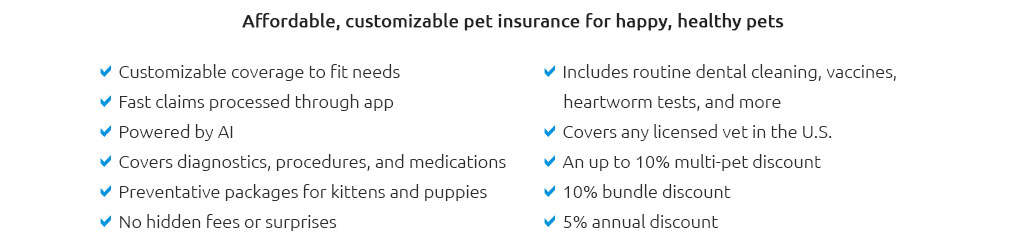

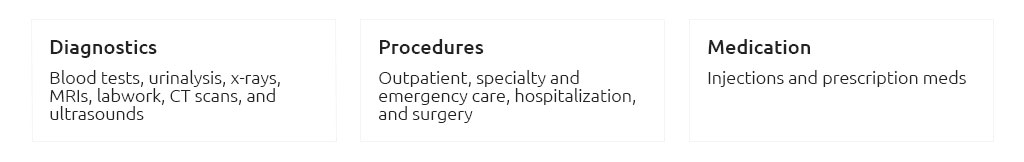

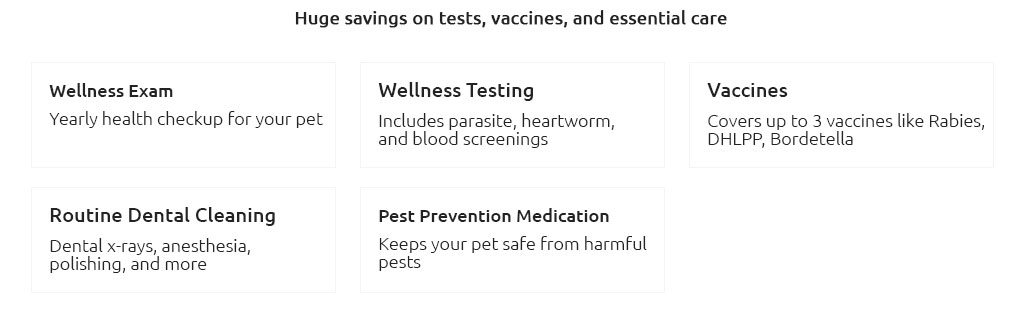

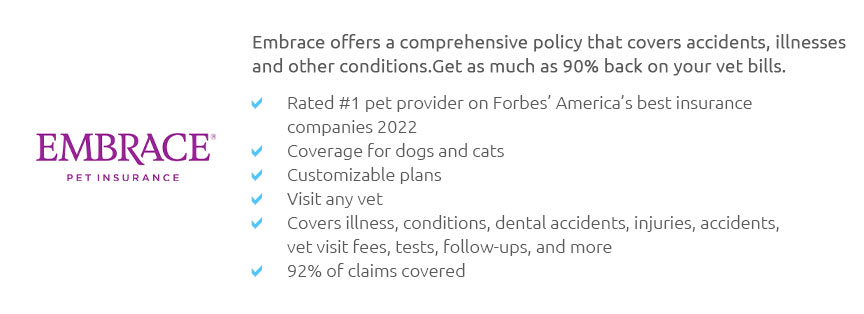

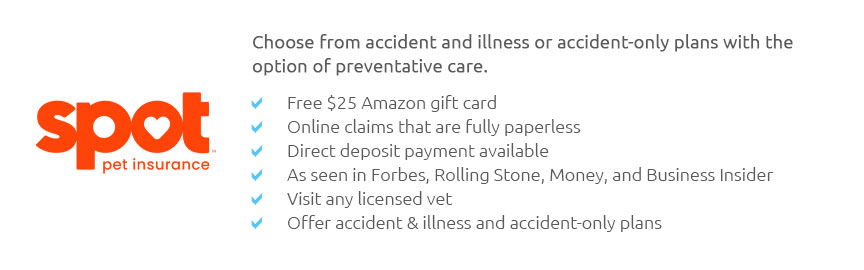

Best Pet Insurance for Shih Tzu Owners: A Comprehensive GuideWhy Shih Tzus Need Specialized InsuranceShih Tzus are a beloved breed known for their playful nature and affectionate demeanor. However, like all breeds, they come with specific health concerns that make pet insurance a smart choice. Common issues include breathing difficulties, hip dysplasia, and eye problems. Top Insurance Providers for Shih Tzus1. Coverage OptionsWhen selecting a policy, consider plans that offer comprehensive coverage for hereditary conditions, routine care, and emergency services. Providers like major medical pet insurance often have tailored options. 2. Cost and Value

What to Look for in a Shih Tzu Insurance PolicyImportant Features

For more tailored options, consider exploring different medical insurance for your pet to ensure comprehensive coverage. Frequently Asked QuestionsWhat is the average cost of insuring a Shih Tzu?The average cost can range from $30 to $50 per month, depending on the level of coverage and the insurer. Are hereditary conditions covered?Yes, many insurance providers offer coverage for hereditary conditions, but it's essential to confirm this in the policy details. Can I get insurance for an older Shih Tzu?While some insurers have age limits, many offer plans tailored for senior pets, though premiums may be higher. ConclusionInvesting in the right pet insurance ensures that your Shih Tzu receives the best care possible without financial strain. By considering the specific needs of the breed and exploring various options, you can find a plan that offers peace of mind and comprehensive protection. https://www.fetchpet.com/pet-insurance/breeds/shih-tzu

The average monthly premium for a Shih Tzu in the U.S. is $28. The most common limit is $5,000, The most common deductible is $300, and the most common copay is ... https://manypets.com/us/pet-insurance/dog-insurance/pure-breeds/shih-tzu-insurance/

ManyPets covers (and adores!) Shih Tzus. Learn about this amazing breed, from common health conditions to insurance info. https://www.petassure.com/education/dog-breeds/shih_tzu-pet-insurance/

You could also consider enrolling in Pet Assure, a veterinary discount plan that is a low-cost pet insurance alternative. This plan has no exclusions due to age ...

|